Easy Steps for Getting the Best Loan for Your Needs

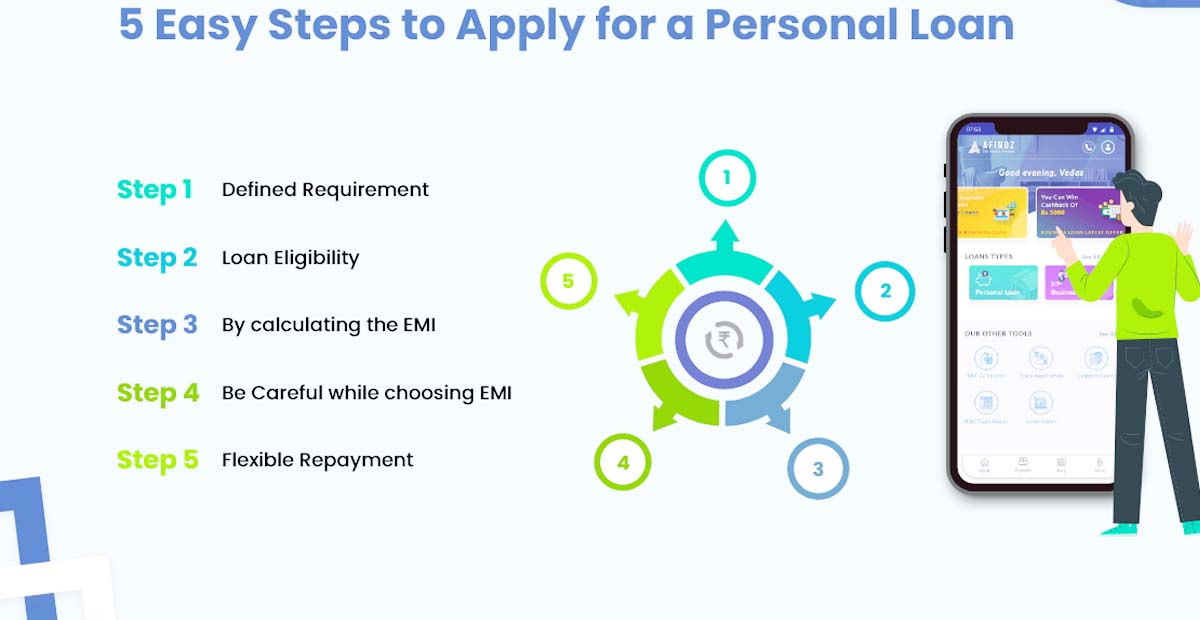

Getting the best loan for your needs involves careful consideration and research. Here are some easy steps to help you find the most suitable loan:

- Determine Your Loan Purpose:

- Start by identifying why you need the loan. Is it for a home, car, education, business, or personal expenses? Understanding your purpose will help you choose the right type of loan.

- Assess Your Financial Situation:

- Review your current financial situation, including income, expenses, savings, and credit score. A good credit score can often help you qualify for better loan terms.

- Set a Realistic Budget:

- Calculate how much you can comfortably afford to borrow and repay each month without straining your finances. This will help you determine the loan amount you should seek.

- Research Loan Types:

- Different loans have different terms and conditions. Research the types of loans available, such as personal loans, mortgages, auto loans, and student loans. Understand the pros and cons of each.

- Compare Lenders:

- Shop around and compare loan offers from multiple lenders, including banks, credit unions, online lenders, and peer-to-peer lending platforms. Look for lenders that offer competitive interest rates and terms.

- Check Your Credit Score:

- Obtain a copy of your credit report and check your credit score. A higher credit score can help you qualify for lower interest rates. Correct any errors in your credit report before applying for a loan.

- Pre-Qualify for Loans:

- Many lenders offer pre-qualification, which provides an estimate of the loan amount and interest rate you may qualify for without a hard credit inquiry. This can help you narrow down your options.

- Review Loan Terms:

- Read the loan terms carefully, including the interest rate, loan duration, monthly payments, and any fees associated with the loan. Make sure you understand all the terms and conditions.

- Ask Questions:

- Don’t hesitate to ask the lender questions about the loan. Clarify any doubts you may have, and request written information about the loan offer.

- Compare APR:

- The Annual Percentage Rate (APR) includes both the interest rate and any applicable fees. Compare the APRs of different loan offers to get a more accurate picture of the total cost of borrowing.

- Consider Loan Repayment Plans:

- Depending on the type of loan, you may have various repayment plans to choose from. Evaluate which plan aligns best with your financial goals and budget.

- Read Reviews and Check References:

- Research the lender’s reputation by reading customer reviews and checking references. Look for feedback on customer service and reliability.

- Gather Required Documentation:

- Prepare all the necessary documentation, such as income statements, tax returns, and identification, as required by the lender.

- Apply for the Loan:

- Complete the loan application with the chosen lender. Be truthful and accurate in your application.

- Review Loan Offers:

- Once you receive loan offers, carefully review them and select the one that best meets your needs and offers the most favorable terms.

- Close the Loan:

- After choosing a lender, finalize the loan agreement, sign the necessary documents, and meet any additional requirements.

- Monitor Your Loan:

- Keep track of your loan payments and statements to ensure you stay on top of your financial commitments.

By following these steps and being diligent in your research and evaluation, you can increase your chances of securing the best loan for your needs and financial situation.